Crypto: Confirmed Casino

Recall when retail businesses and abundance administrators got into crypto?

Noted Tesla bulls at Gerber Kawasaki got the mid 2021 bitcoin cost top. Intelligence Tree and Ritholtz Wealth Management, when they cooperated to make a crypto file before the end of last year, may have top-ticked the whole market. Then US abundance the board goliath Fidelity got on board with that fleeting trend brought a monster jump into crypto in April*, when bitcoin was down almost 20% for the year yet at the same time exchanging above $35,000. It has since fallen beneath $21,000. 온라인카지노

Probably, these establishments chose to let individuals YOLO their retirement cash into digital currency for the potential expansion benefits.

However, a new report from the Swiss Finance Institute blasts that air pocket. A couple of scholastics — Luciano Somoza and Antoine Didisheim of the University of Lausanne — broke down information from an irregular example of clients of Swissquote, one of a handful of the controlled banks that likewise offers crypto-exchanging administrations. Of the 77,364 dynamic records they contemplated, around 21% exchanged cryptographic money. 온라인카지노

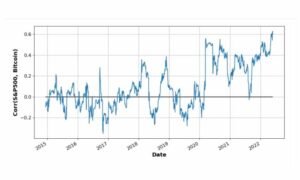

Their discoveries assist with making sense of why the connection between’s the S&P 500 and Bitcoin costs seems to be this:

So, they contend that cryptographic money and stock costs have been profoundly corresponded on the grounds that eager for risk retail punters have been exchanging stocks and digital currencies together.

The scholastics found that the pattern began “abruptly” in the beginning of the pandemic in 2020, when the connection among’s Bitcoin and the S&P 500 bounced from zero to almost 60%.

Somoza and Didisheim quality this to retail dealers’ upgrade checks — however Alphaville can’t resist the urge to see that the leap in retail exchanging happened right when card sharks’ standard fields were restricted, with club shut and most games dropped.

Regardless of the thinking, the crypto brokers caught by the overview truly do give off an impression of being the betting sort:

Please use the sharing tools found via the share button at the top or side of articles. 카지노사이트

Subscribers may share up to 10 or 20 articles per month using the gift article service. More information can be found here.

“. . . looking at the stocks favoured by agents who hold cryptocurrencies, we observe a strong preference for growth stocks and speculative assets. When agents open a cryptocurrency wallet, their overall portfolio becomes riskier, with higher annualised returns which comes at the expense of volatility aggregating into a significantly lower Sharpe Ratio (-10.23 per cent, annualised).

The scholastics additionally found that the stocks generally preferred by crypto merchants will quite often be the most related with crypto costs. So these financial backers are either purchasing both crypto and speculative stocks on the double, or selling both immediately.

At the point when these dealers opened crypto wallets, they began checking their investment funds considerably more frequently.

Likewise engaging is that these financial backers exchanged stocks less frequently when they opened a crypto wallet, so the exhibition of their non-crypto portfolios gotten to the next level.

Obviously, in the event that we expect to be that 1) regular exchanging is terrible for a singular financial backer’s exhibition and 2) individuals who long for hitting a little monetary gamble button are bound to open a digital currency account, that result checks out. On the off chance that financial backers get their unpredictability fix from crypto, there’s less need to YOLO into selling puts on Gamestop.

Put differently:

” Digital currency financial backers exchange more stocks on normal yet less so in the wake of opening a cryptowallet. This impact isn’t brought about by the overall lower weight of stocks in the portfolio nor by the sum contributed, as the reliant variable is scaled by stock property. A potential understanding is that financial backers try to ignore stocks once they exchange cryptographic forms of money and subsequently exchange them on rare occasions. This outcome could make sense of part of the greater Sharpe proportions [in their stock portfolios.] furthermore, we observe that exchanging stocks is corresponded with exchanging cryptographic forms of money. At the end of the day, when they open a wallet, financial backers exchange less stocks, and they exchange them simultaneously as digital forms of money.”

So these retail merchants are into facing challenges. In any case, it’s potential they essentially have more cash to squander on betting, correct?

Indeed, the information “propose that crypto-arranged retail financial backers are, on normal less fortunate, more youthful, more male, more dynamic, and quicker on facing challenges,” the creators composed.